The Capital One Platinum Mastercard is a popular credit card that offers cash back and other benefits with no annual fee. If you’ve recently applied for and received this card, you’ll need to activate it before use.

This comprehensive guide covers everything you need to know, from online and phone activation methods to eligibility, application tips, and frequently asked questions.

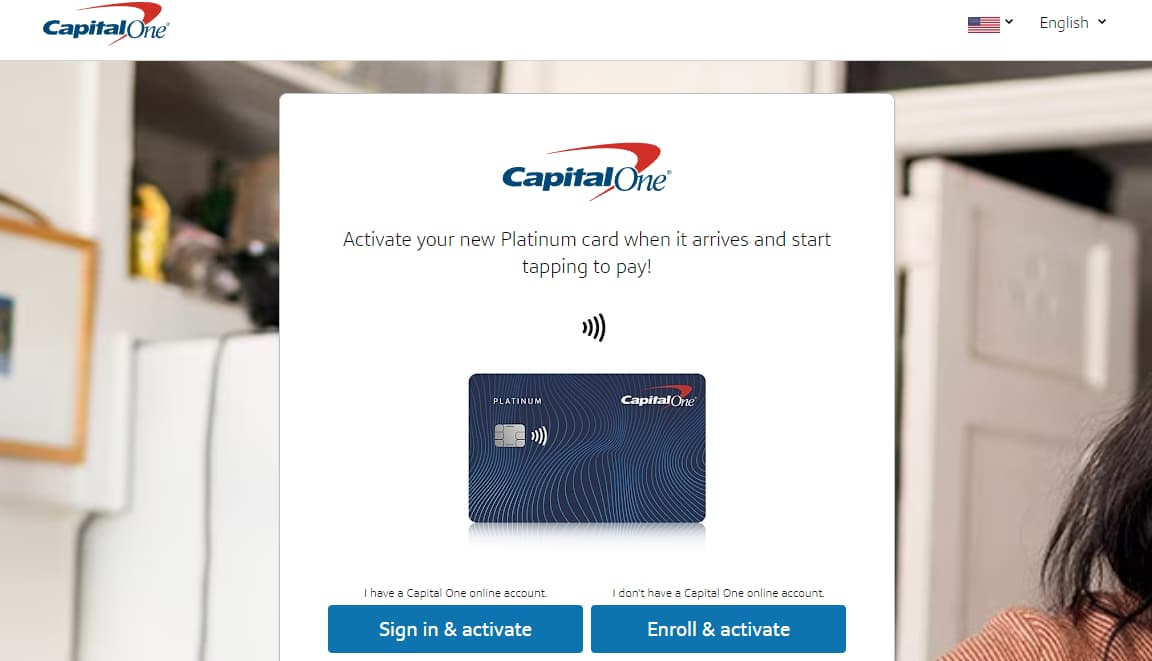

Platinum.CapitalOne.com/Activate

Follow along for easy-to-understand guidance on activation and application, with visual depictions of the online portal and mobile app.

Why Choose the Capital One Platinum Card?

- No annual fee – Unlike many rewards cards, the Platinum Card has no annual fee.

- 1.5% cash back on every purchase – Straightforward unlimited 1.5% cash back.

- No foreign transaction fees – Save on purchases abroad.

- Credit line increases – Opportunity to increase your limit with responsible use.

- $0 fraud liability – Protection against unauthorized charges.

- Free credit monitoring – Track your TransUnion credit score for free.

With valuable perks and accountability features, it’s an excellent card for building credit.

How to Activate Capital One Platinum Mastercard at Platinum.CapitalOne.con/Activate?

Activating your card is crucial for protection against fraud and identity theft. Here are the easy methods for activation:

Activate Online Through Account Login

Activating online is fast and secure. Simply follow these steps:

- Go to platinum.capitalone.com/activate.

- Click “Sign In & Activate”.

- Enter your account username and password.

- Click “Activate My Card” on your account dashboard.

- Enter your new card details – card number, expiration date, CVV security code.

- Verify your identity by answering security questions.

- Click “Activate” to complete the activation.

You’re all set! Your card will now work for online and in-store purchases.

Activate Through the Capital One Mobile App

The Capital One app makes it easy to activate anytime, anywhere:

- Download the app for iPhone or Android.

- Log into your account.

- Tap the profile icon in the top right corner.

- Select “Activate Card” under services.

- Enter card details and security code.

- Verify identity and click “Activate”.

It only takes a few minutes through the convenience of your smartphone.

Activate by Calling the Number on Your Card

Don’t have internet access? You can activate it by calling:

- 1-800-227-4825

An automated system will guide you through:

- Enter card number when prompted.

- Provide identity details like SSN and home address.

- Follow the instructions to activate a card with a few button pushes.

A customer service agent can also help activate over the phone if you prefer talking to a live representative. Just have your card handy.

How to Apply for the Capital One Platinum Mastercard?

Ready to join over 10 million Cardholders? Applying is quick and easy in minutes.

Eligibility Requirements

To qualify for the Platinum card, you must:

- Be 18+ years old: The minimum age to apply

- Have a valid Social Security Number: Required for card and application

- Be a U.S. citizen or resident: Available only to those in the 50 states and Washington D.C.

Your credit score will also be evaluated but there is no minimum credit score requirement. The card is suitable for average credit scores as a starter card for building credit.

Application Tips

- Have personal information ready:

- Full legal name.

- Home address.

- Date of birth.

- Social Security Number.

- Provide income details:

- Employment status.

- Total annual individual or household income.

- Enter contact info:

- Email.

- Primary phone number.

- List checking/savings accounts: Helps determine approval.

- Check for pre-approval: See if you pre-qualify with a soft credit check before formally applying.

With these handy tips, your application has the best chance of swift processing and approval.

Easy Application Steps

Applying online takes less than 10 minutes.

Simply:

- Go to CapitalOne.com and choose “Credit Cards”.

- Click “Apply Now” on the Platinum Card listing.

- Fill the secure application with personal, income, and contact details.

- Read the terms and conditions.

- Click “Submit” and wait for an instant decision.

Once approved, your card will arrive in 7-10 business days. Activate upon receipt before usage.

Frequently Asked Questions About the Card

Here are answers to the top 10 FAQs about account activation, application qualifications, credit limits, and usage:

- 1. What’s the minimum credit limit?

The minimum credit line is $300. The actual limit depends on creditworthiness.

- 2. How to increase the credit limit?

Responsible card usage can prompt automatic periodic increases from Capital One. You can also request an increase after 5 months.

- 3. Does the card have foreign transaction fees?

No. You won’t be charged additional fees on international purchases.

- 4. Can the card help build credit?

Yes! Regular on-time payments help strengthen your credit history.

- 5. How long for card delivery after approval?

Allow 7-10 weekdays for card shipping after approval.

- 6. What perks and rewards are offered?

You’ll earn an unlimited 1.5% cash back on all purchases. No rotating bonus categories to keep track of.

- 7. Is there an intro 0% APR period?

Unfortunately, no intro APR offer is available at this time for purchases or balance transfers.

- 8. What’s the late payment fee amount?

The typical late fee amount is around $40. Please pay bills on time to avoid penalties.

- 9. Does the card have an annual fee?

Nope! The Platinum card has no annual fee.

- 10. Is a co-signer allowed when applying?

Yes. Adding an authorized user over 21 can improve your chances for approval.

Reach out to Capital One customer service with any other questions. Their team is available 24 hours a day, 7 days a week.

Also Check: MyCenturyLinkPrepaidCard com

Conclusion: Activate Now to Enjoy Valuable Platinum Card Benefits

In closing, the Capital One Platinum Mastercard makes it easy to take control of your credit. Activate the card through any of the provided methods: a convenient online portal, user-friendly mobile app, or automated phone line.

Qualified applicants will benefit from unlimited 1.5% cash back, no annual fee, and robust credit tools for building their financial foundation.

We covered the key steps for a smooth application and activation process. Check your eligibility, prepare the required documents, and provide accurate information, and you’ll be on the way to rewards and elevated credit standing.

Act now to start enjoying everything this top starter card has to offer at no cost.