Credit cards have become an essential financial tool for many people, offering convenience, rewards, and often additional perks.

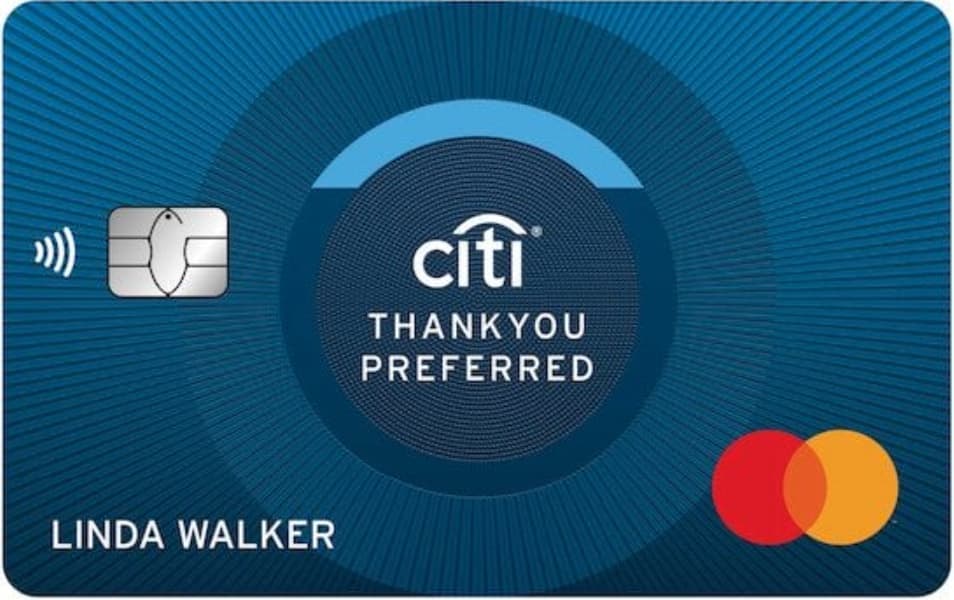

Among the various options available, the Citi ThankYou Preferred Card has been a popular choice for those who enjoy dining out and entertainment.

This article aims to provide a comprehensive guide to the Citi ThankYou Preferred Card offer, exploring its features, application process, and benefits.

The Citi ThankYou Preferred Card, available at www.citi.com/thankyoupreferredcardapplynow, has been designed to cater to individuals who lead active social lives and enjoy spending on dining and entertainment.

With its rewards program focused on these categories, the card has attracted many users looking to maximize their benefits from everyday spending.

www.citi.com/thankyoupreferredcardapplynow – Citi ThankYou Preferred Card Offer

In this guide, we’ll delve into the details of the Citi ThankYou Preferred Card, discussing its key features, how to apply, and what current and potential cardholders should know.

We’ll also explore the pros and cons of the card, provide information about Citi as a company, and answer some frequently asked questions to help you make an informed decision about whether this card is right for you.

What is the Citi ThankYou Preferred Card Offer?

The Citi ThankYou Preferred Card offer is a credit card program designed to reward cardholders for their spending, particularly in the categories of dining and entertainment.

This card is part of Citi’s ThankYou Rewards program, which allows users to earn points on their purchases that can be redeemed for various rewards.

Key aspects of the offer include:

- No annual fee

- Rewards points on purchases

- Introductory APR periods for purchases and balance transfers

- Access to Citi’s ThankYou Rewards program

The card is targeted at consumers who frequently dine out, and attend movies, concerts, and other entertainment events. By offering enhanced rewards in these categories, Citi aims to attract users who can benefit most from the card’s structure.

Features of Citi ThankYou Preferred Card

The Citi ThankYou Preferred Card comes with several features that make it attractive to potential users. Let’s break down these features in detail:

1. Rewards Program

- Earn 2X points on dining and entertainment purchases

- Earn 1X points on all other purchases

- No limit on the number of points you can earn

- Points don’t expire

2. Introductory APR Offers

- 0% intro APR on purchases for 15 months from account opening

- 0% intro APR on balance transfers for 15 months from date of first transfer

3. Fees

- No annual fee

- Balance transfer fee: 3% of each transfer (minimum $5)

- Foreign transaction fee: 3% of each purchase transaction in U.S. dollars

4. Redemption Options

- Gift cards to popular retailers, restaurants, and stores

- Travel rewards

- Cashback

- Merchandise

5. Additional Benefits

- Citi Entertainment: Access to presale tickets and exclusive experiences

- Citi Identity Theft Solutions: Help with identity theft issues

- Citi Quick Lock: Easily lock your card if misplaced

These features combine to create a card that can be particularly valuable for people who frequently dine out or enjoy entertainment activities.

The lack of an annual fee also makes it an attractive option for those who want to earn rewards without paying for the privilege.

Citi Thank You Preferred Card Apply Now

If you’re interested in applying for the Citi ThankYou Preferred Card, you can do so through the official Citi website at www.citi.com/thankyoupreferredcardapplynow.

The application process is designed to be quick and straightforward, typically taking only a few minutes to complete.

Here’s what you need to know about the application process:

- Invitation Number: If you’ve received a mail offer, you’ll need to provide the invitation number found on the right-hand side of the promotional offer.

- Personal Information: You’ll need to provide basic personal details such as your name, address, and Social Security number.

- Financial Information: Be prepared to share information about your income and employment.

- Credit Check: Citi will perform a credit check as part of the application process.

- Instant Decision: In many cases, you’ll receive an instant decision on your application.

Important points to remember:

- Only the person who received the offer can apply using the unique invitation number.

- Applicants must be at least 18 years old.

- Excellent credit is typically required for approval.

If you didn’t receive a mail offer, you may still be able to apply online, but your chances of approval might be lower compared to those with a specific invitation.

Citi ThankYou Preferred Card Comments

User feedback and comments about the Citi ThankYou Preferred Card can provide valuable insights for those considering applying. Here’s a summary of common comments and observations from cardholders:

Positive Comments:

- Great for dining out: Many users appreciate the double points on restaurant spending.

- Entertainment value: Cardholders who frequently attend movies or concerts find the 2X points on entertainment purchases valuable.

- No annual fee: The lack of an annual fee is often cited as a significant benefit.

- Easy to use rewards: Users generally find the ThankYou Rewards program straightforward to navigate and redeem points.

Negative Comments:

- Foreign transaction fee: The 3% foreign transaction fee is a drawback for international travelers.

- Limited bonus categories: Some users wish for more categories that earn bonus points.

- Point value: A few cardholders feel the redemption value of ThankYou points could be better.

Overall, the card seems to be well-received by its target audience – those who frequently dine out and enjoy entertainment activities. However, it may not be the best choice for heavy travelers or those looking for a wider range of bonus categories.

Citi ThankYou® Preferred Card Pros & Cons

To help you make an informed decision, let’s break down the pros and cons of the Citi ThankYou Preferred Card:

Pros:

- No annual fee: This allows you to earn rewards without paying for the privilege.

- Double points on dining and entertainment: Great for those who frequently eat out or enjoy entertainment activities.

- Introductory APR offers: The 0% intro APR on purchases and balance transfers can be valuable for managing finances.

- Flexible redemption options: Points can be redeemed for a variety of rewards, including gift cards, travel, and cash back.

- No expiration on points: Your earned points don’t expire as long as your account is open and in good standing.

Cons:

- Foreign transaction fee: The 3% fee on foreign transactions makes this card less ideal for international use.

- Balance transfer fee: While there’s an intro APR on balance transfers, there’s still a fee for making transfers.

- Limited bonus categories: Some competitors offer bonus points in more categories.

- Requires excellent credit: This card may be difficult to qualify for if you don’t have a strong credit history.

About Citi

Citigroup Inc., commonly known as Citi, is a major player in the global financial services industry. Understanding the company behind the card can provide context for potential cardholders.

Key facts about Citi:

- Founded: 1812

- Headquarters: New York City

- Services: Investment banking, financial services, credit cards

- Global presence: Operates in over 160 countries

Citi has a long history in the banking industry and is considered one of the “Big Four” banks in the United States, alongside JPMorgan Chase, Bank of America, and Wells Fargo.

The company offers a wide range of financial products and services, including various credit cards like the Citi ThankYou Preferred Card.

Citi’s credit card offerings are known for their rewards programs, with the ThankYou Rewards program being one of their flagship offerings. This program allows cardholders to earn and redeem points for a variety of rewards, making Citi cards attractive to many consumers.

The company’s size and global reach can be advantageous for cardholders, potentially offering greater stability and a wider range of services. However, as with any large financial institution, customer experiences can vary.

Citi has also been investing in digital banking technologies, aiming to provide more convenient and accessible services to its customers. This includes features like mobile banking apps and online account management tools.

FAQs:

To address some common questions about the Citi ThankYou Preferred Card and related topics, here are answers to frequently asked questions:

- 1. Is Citi ThankYou Preferred card discontinued?

As of the most recent information available, the Citi ThankYou Preferred Card may no longer be available to new applicants. Citi periodically reviews and updates its credit card offerings, and this particular card may have been replaced or discontinued. If you’re interested in a similar card from Citi, it’s best to check their current offerings at www.citi.com/thankyoupreferredcardapplynow or contact Citi directly for the most up-to-date information.

- 2. How do I login to my Costco Citi credit card?

To log in to your Costco Citi credit card account:

- Go to the Citi website

- Click on “Sign On” in the top right corner

- Enter your User ID and Password

- Click “Sign On”

If you haven’t set up online access yet, you’ll need to register first by clicking on “Register for Online Access” and following the prompts.

- 3. How do I login to my Citi card account online?

The process is similar for all Citi card accounts:

- Visit Citi’s official website

- Click “Sign On” in the upper right corner

- Enter your User ID and Password

- Click “Sign On”

If it’s your first time, you’ll need to register for online access by clicking “Register for Online Access” and following the instructions.

- 4. How do I redeem my Citi ThankYou points?

To redeem Citi ThankYou points:

- Log in to your Citi account online or via the mobile app

- Navigate to the ThankYou Rewards section

- Browse available redemption options (gift cards, travel, cash back, etc.)

- Select your desired reward and follow the prompts to complete the redemption

Remember, redemption options and values can vary, so it’s worth comparing different choices to get the best value for your points.

- 5. How much is the Citi ThankYou Preferred Card membership fee?

The Citi ThankYou Preferred Card typically has no annual membership fee. This is one of its attractive features, allowing cardholders to earn rewards without paying an annual cost. However, always check the current terms and conditions at www.citi.com/thankyoupreferredcardapplynow, as credit card terms can change over time.

- 6. Is Citibank discontinuing ThankYou points?

As of the latest information available, Citibank is not discontinuing ThankYou points. The ThankYou Rewards program remains an integral part of many Citi credit card offerings. However, specific cards within the program may be discontinued or changed over time. It’s always best to check Citi’s current offerings and terms for the most up-to-date information.

Conclusion:

The Citi ThankYou Preferred Card, which was available at www.citi.com/thankyoupreferredcardapplynow, has been a popular choice for consumers who frequently dine out and enjoy entertainment activities.

Its reward structure, focusing on these categories, made it an attractive option for many cardholders.

Key features of the card included:

- No annual fee

- 2X points on dining and entertainment purchases

- 1X points on all other purchases

- Introductory APR offers on purchases and balance transfers

While these features made the card appealing to many, it’s important to note that credit card offerings can change over time.

As of the most recent information, the Citi ThankYou Preferred Card may no longer be available to new applicants.

However, the principles behind this card – rewarding everyday spending in popular categories without an annual fee – remain relevant in the credit card market.

For those interested in similar offerings, it’s worth exploring Citi’s current credit card lineup at www.citi.com/thankyoupreferredcardapplynow.

You may find other options that provide comparable or even enhanced benefits tailored to your spending habits and financial goals.

Remember, when choosing a credit card, it’s crucial to consider your spending patterns, financial situation, and goals. Look for a card that aligns with your needs, whether that’s maximizing rewards, minimizing fees, or accessing specific benefits.

Ultimately, the right credit card can be a valuable financial tool, helping you manage your spending, earn rewards, and potentially save money through introductory offers and ongoing benefits.

Whether it’s the Citi ThankYou Preferred Card or another option, the key is to use your card responsibly and take full advantage of the benefits it offers.

Also Check: