The Mission Lane Visa credit card is a relatively new offering in the credit card space that aims to provide transparency and responsible lending to consumers.

As a startup credit card company, Mission Lane faces the challenge of getting the word out about its card and convincing customers to sign up.

A key step in that process is enabling new cardholders to activate their cards through clear and convenient methods.

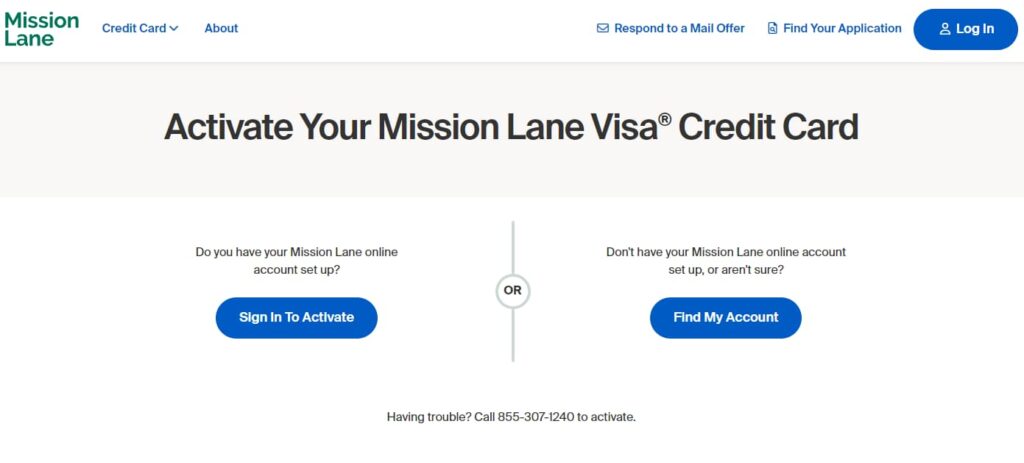

Mission Lane Card Activation Process 2024 at www.MissionLane.com/Activate

In this comprehensive guide, we will explore the Mission Lane credit card and its benefits, provide step-by-step instructions for activating your card either online or by phone, and offer tips for managing your account going forward.

When you receive your new Mission Lane credit card in the mail, you have two convenient options to activate it – either through their user-friendly website at www.missionlane.com/activate or by calling their 24/7 customer service line at 1-800-456-6870.

Overview of the Mission Lane Credit Card

Mission Lane was founded in 2020 by entrepreneurs passionate about financial inclusion and empowerment.

Their stated goal is to help everyday Americans build their credit and access fair, affordable lending products to achieve their financial goals.

Some of the key benefits offered by the Mission Lane Visa card include:

- No hidden fees or “gotcha” pricing.

- Clear, transparent pricing and terms.

- Credit limit increases over time for responsible cardholders.

- 24/7 U.S.-based customer service.

- Online account management and spending insights.

Additionally, Mission Lane does not charge late fees or penalize cardholders for missed payments with spikes in interest rates.

They also report customer payment history to all three main credit bureaus, allowing users to build their credit scores over time when using the card responsibly.

This combination of responsible lending practices and tools to improve financial well-being makes the Mission Lane card worth considering for those who need to build or rebuild their credit.

Mission Lane Card Activation Process 2024 at www.MissionLane.com/Activate

If you’ve recently received a Mission Lane credit card offer by mail or signed up for a card through their website, you’ll need to activate your card before you can begin using it for transactions.

Here are the two main methods for activating your new Mission Lane card:

Method 1) Activate Online

The quickest and easiest way to activate your Mission Lane card is through the bank’s secure online portal.

Follow these steps:

- Visit Mission Lane’s card management website: www.missionlane.com/activate

- If you already have an online account with Mission Lane, log in with your credentials. If you do not have an account, you will need to create one by providing some personal information.

- Once logged into your account, find your new Mission Lane card listed and click the “Activate Card” button next to it.

- A page will load displaying your full card number with activation instructions. Follow the on-screen prompts to complete the card activation process.

- Make sure to set a PIN number and customize other card settings like transaction alerts while logged into your account.

And that’s it! Once activated online, your Mission Lane card is ready for use anywhere Visa is accepted.

If you don’t have an account to activate your Mission Lane credit card online, then follow the below process first.

Registration Follow these steps to sign up for a new account on Missionlane.com:

- Go to www.missionlane.com and click on “Register” in the top right corner or click here.

- Enter your personal details like name, date of birth, Social Security Number, address, phone number, and email address.

- Read and electronically sign their Terms & Conditions document.

- Create a secure password for your account that meets password complexity requirements.

- Select and answer three security questions to help verify your identity when recovering your login or password.

- Click the “Register Account” button upon completion.

- Check your email inbox for a confirmation link to activate your new account.

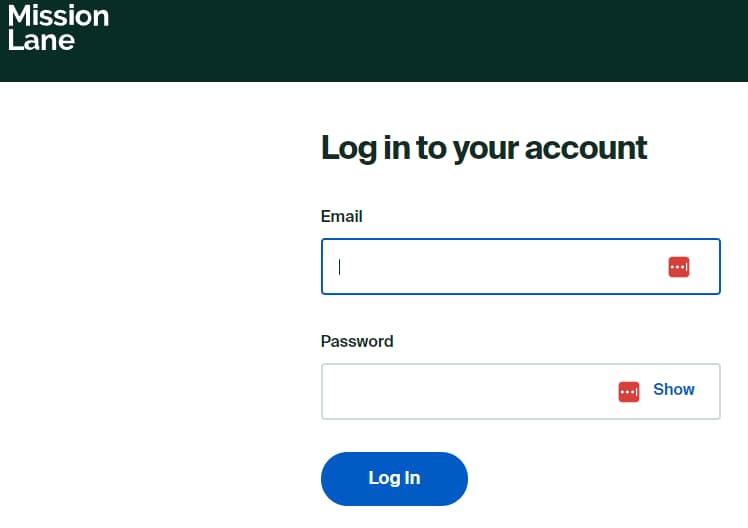

Logging In To log in to your Missionlane Account After Registration:

- Visit www.missionlane.com and click “Log In” on the top right menu

- Enter your registered email address and the password you created.

- If prompted, complete any two-factor authentication required for account security.

- Review and agree to the latest Terms & Conditions if presented.

- Access your account dashboard and online banking features once logged in.

Activating Your Mission Lane Card Follow below steps to activate your new credit card through your account:

- Locate the “My Cards” section and select your new Mission Lane card.

- Verify your personal details like SSN and date of birth match application.

- Click the “Activate Card” button and follow the on-screen instructions.

- Set up one-time and recurring transaction alerts for both your safety and convenience through the easy prompts.

- Review all pre-approved credit terms and commit to responsible usage.

- Your Mission Lane card will activate and be ready for immediate use once the online process is completed.

Recovering Forgotten Login Username or Password:

If you ever forget your Missionlane account login credentials, use their automated recovery tools:

To recover your forgotten password:

- Click the “Forgot Password” link on Missionlane’s login page.

- Enter your registered email address when prompted.

- Answer your preset security questions properly to confirm identity.

- Automatically receive an email with a secure password reset link.

- Follow the instructions in the email to create and confirm a new account password.

To recover your registered username:

- Click “Forgot Username” on their login page.

- Provide requested contact information like SSN and date of birth.

- Your registered username will display on the screen once verified.

Method 2) Activate By Phone

If you prefer to speak with a live representative when activating your card, you can call Mission Lane’s 24/7 customer service line at 1-800-456-6870.

When you call, make sure to have the following information handy so the agent can swiftly locate your account and submit the activation:

- Full card number.

- Your name and home address.

- The last 4 digits of your Social Security Number.

The agent will then walk you through the steps to activate your card over the phone and set your PIN number. The whole process takes less than 10 minutes when calling.

Tips for Managing Your Mission Lane Credit Card Account

Activating your new Mission Lane card is just the first step on your journey with Mission Lane. Be sure to take full advantage of your account by following these tips:

- Log into your online account regularly to view statements, keep tabs on spending, and detect any fraudulent transactions. You can also manage notifications and other preferences through your online account.

- Consider setting up autopay from your linked bank account to pay your monthly bill in full. This prevents late fees, ensures you never miss a payment and demonstrates responsible usage that may qualify you for a higher credit limit over time.

- Use your Mission Lane card for everyday purchases but be careful not to overspend beyond your limit. Pay attention to your outstanding balance owed and aim to pay it off in a timely manner each month.

- Take advantage of Mission Lane’s free credit score monitoring and educational resources in your online account dashboard. This can help you better understand factors impacting your credit and ways to improve it over time.

- Contact Mission Lane’s customer service if you ever have questions about annual percentage rates, potential credit line increases, or any other aspects of managing your account. They have U.S.-based representatives available 24/7.

Mission Lane Customer Support:

- Having trouble? Call 855-307-1240 to activate.

Frequently Asked Questions About Activating and Managing a Mission Lane Credit Card Account

- Q1: How long does it take for my Mission Lane card to activate once I submit a request online or over the phone?

It typically takes less than 5 minutes for Mission Lane to activate your card once you initiate the process through their website or customer service center. You will receive a real-time confirmation during the activation process.

- Q2: Do I need to have a Mission Lane bank account to activate my Mission Lane credit card?

No, you do not need an existing bank account with Mission Lane. During the application and approval process for a new card, you will provide banking details for the outside account you wish to use to pay your monthly credit card bill.

- Q3: Is there a spending limit on my Mission Lane card as soon as it is activated?

Yes, Mission Lane will assign your credit card a pre-set spending limit based on your approved credit amount. This spending cap will appear on your monthly statements and online account dashboard. As a responsible cardholder, you should not charge over the limit unless given expressed permission by Mission Lane.

- Q4: How do I track rewards points or cash back earned with my Mission Lane card?

You can view any rewards points or cash-back earnings from Mission Lane card purchases by logging into your online account dashboard. Click on the “Rewards” tab to access your full rewards activity, redemption options, and program details.

- Q5: Who do I contact if my Mission Lane card is lost, stolen, or compromised?

You must contact Mission Lane’s 24/7 customer service line immediately at 1-800-456-6870 if your card becomes lost, stolen, or compromised in any way. Their team can instantly freeze your card to prevent fraudulent charges and expedite mailing you a replacement card for continued use after the incident.

- Q6: Why was my Mission Lane credit card application declined?

Mission Lane may decline applications for new credit cards for various reasons related to an applicant’s credit score, current debt obligations, and income on record not meeting the company’s lending standards. If your application was declined, Mission Lane is legally required to provide the exact reasons why you did not qualify at this time.

- Q7: Does Mission Lane report my credit card payment history to the three main credit bureaus?

Yes, one of the major benefits of the Mission Lane card is that the company positively reports all on-time monthly payments to TransUnion, Experian, and Equifax. This allows responsible cardholders to build long-term credit history which can raise your scores with the bureaus.

- Q8: How often does Mission Lane evaluate my account for a credit line increase?

Mission Lane conducts account reviews every six months to identify cardholders who may qualify for automatic credit limit boosts based on good standing and responsible usage showing you deserve expanded purchasing power. There is no need to manually request credit line reviews.

- Q9: What steps can I take to lower my APR with Mission Lane?

The single best way to decrease your APR with Mission Lane over time is to diligently pay your balance off in full and on time every month. This builds trust and signals you are ready to be tagged at lower interest rates for future purchases. Consistently carrying a balance month-to-month leads to higher APRs.

- Q10: Who is the best contact for general questions about my Mission Lane account?

Mission Lane wants cardholders to easily get answers when managing accounts. Contact their helpful, U.S.-based customer service team 24/7 by calling 1-800-456-6870 or through online chat messaging when logged into your account. Whether general account questions or detailed inquiries, their reps aim to deliver quick, complete resolution.

More Activation Guides:

- Activate.LLBean Mastercard.com

- Bank of America/plasma loyalty card Activate

- OpenMyPremiercard Net Activate

- www.ReiMastercard/Activate

- Comenity Net Boscov’s Activate

- Suntrust.com/activatemycard

The Bottom Line

The foundation of any new credit card account is properly activating your physical credit card so you can start using it for daily purchases or payments.

Mission Lane offers a user-friendly activation process online or over the phone. Within minutes, you can have your card ready for shops, restaurants, travel, and more.

Be sure to closely monitor your spending activity and credit score using Mission Lane’s online account tools.

Develop smart money management habits that demonstrate financial responsibility to benefit from credit line increases over time. Avoid expensive late fees or interest charges by paying your bill on time and in full each month.

With competitive rates and an emphasis on transparent, fair lending practices for consumers, Mission Lane provides an attractive option for those needing to build a credit history.

Activate your new card without delay using this step-by-step guide and tips to begin unlocking the many perks and positives of this unique credit solution.