Riding on a Harley symbolizes freedom, adventure, and being part of a close-knit community. Now bikers can also ride high with rewards by applying for the customized Harley-Davidson Visa Credit Card online at www.h-dvisa.com/myoffer.

www.h-dvisa.com/myoffer

The H-D Visa Card offers bikers special financing options, discounts, rewards points, gift cards, and more for use at authorized Harley-Davidson dealerships and events.

About the Harley-Davidson Visa Credit Cards

Harley-Davidson offers two types of Visa credit cards – the premium Harley-Davidson Visa Signature Card and the regular Harley-Davidson High-Performance Card.

Both cards are issued by U.S. Bank under a license from Visa Inc.

The Signature card has higher reward rates and more benefits compared to the High-Performance card. Applicants are first considered for the Visa Signature card based on their credit score. If they don’t qualify, they are evaluated for the High-Performance card.

Cardholders of both versions earn rewards points on net purchases made anywhere Visa is accepted.

These points can be redeemed for Harley-Davidson gift cards to use at authorized dealers and shops.

Key Features of the Harley-Davidson Visa Cards

Harley-Davidson Visa Signature Card

- 3 points per $1 spent at H-D dealerships & online store

- 2 points per $1 spent at restaurants, gas stations, hotels

- 1 point per $1 on other purchases

Harley-Davidson High-Performance Card

- 1 point per $1 spent everywhere

Both Cards Offer:

- No annual fee

- Fraud protection and reporting services

- Auto rental collision damage waiver

- Emergency card replacement

- Lost luggage reimbursement

- Sweepstakes to win new Harley-Davidson motorcycles

How to Apply for the Harley-Davidson Visa Credit Card Online at www.h-dvisa.com/myoffer?

Bikers can apply online for the Harley-Davidson Visa Card through two methods:

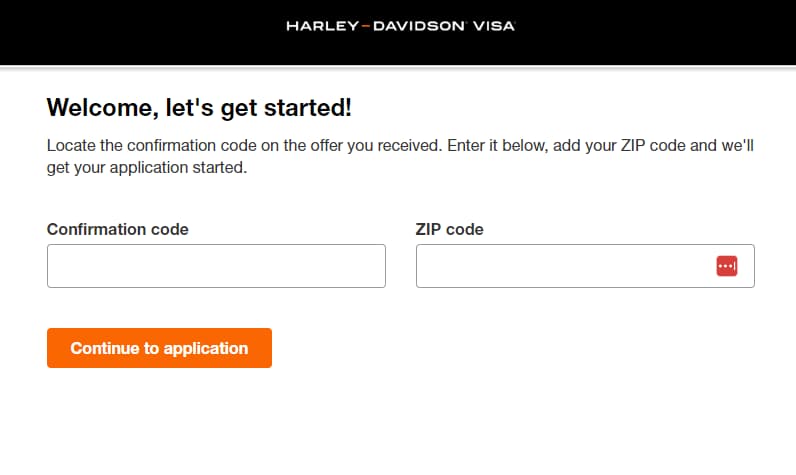

1. Using the Confirmation Code (for pre-qualified invitees)

- Visit www.h-dvisa.com/myoffer via this URL “https://applications.usbank.com/pdap/directMailApply“

- Enter the 9-digit confirmation code from your offer letter

- Input the 5-digit ZIP code and proceed

2. Direct Online Application (for open applications)

- Go to www.h-dvisa.com

- Click on “Apply Now” and fill out the application form

The application requires personal, contact, housing, employment, and financial information including:

Personal Details

- Full legal name

- Date of birth

- Contact numbers

- Email ID

Address Details

- Physical address

- Housing status (rent/own)

- Monthly housing payment

Employment & Income Details

- Employer name

- Job title & employment status

- Annual income

Financial Information

- Social Security Number

- International/ domestic transactions

- Request for a balance transfer

There is also an option to add an authorized user to the account.

Applicants must agree to the terms and conditions before submitting. It takes a few minutes to process after which cardholders are notified about approval/denial based on eligibility.

Top 10 Benefits of the Harley-Davidson Visa Card

Bikers can ride off into the sunset while racking up these 10 rewarding benefits with their customized H-D Visa Card:

- Earn Points for Harley Merch & Accessories: Cardholders can earn rewards on dealership purchases to redeem H-D gift cards. Signature cardmembers get 3 points per $1 spent while High-Performance members get 1 point.

- Rewards for Dining, Gas, Hotels: Visa Signature cardholders also enjoy bonus points on travel and entertainment spending. They earn 2 points per $1 spent at restaurants, gas stations, and hotels.

- Balance Transfer Facility: Bikers carrying debt on other credit cards can transfer balances to the H-D card by paying a fee. This consolidates payments into one account.

- Special Financing Offers: Cardmembers get financing options to pay off their Harley bike, parts, accessories, etc. over time in fixed monthly payments.

- Exclusive Cardmember Support: H-D Visa users get access to dedicated customer service for any card-related queries and assistance.

- Fraud Protection Services: The card provides $0 fraud liability coverage with 24/7 monitoring. Lost/stolen card reporting and emergency card replacement services give added security.

- Rental Car Insurance: When renting cars using the H-D Visa card, collision damage is covered so there’s no need to buy additional policies.

- Worldwide Acceptance: The H-D Visa credit card is accepted at millions of locations globally so bikers can make payments and earn rewards whenever bike night calls.

- Convenient Mobile Wallet: Android/ Apple Pay Integration makes for easy contactless payments using mobile devices wherever Visa is supported.

- Metal Cards Option: Signature cardholders can order premium metal credit cards etched with the iconic Harley-Davidson logo and eagle wings designs.

FAQs About the Harley-Davidson Visa Card

- Q1. How much do Harley-Davidson Visa cards cost?

A1. Both Signature and High-Performance cards have no annual membership or renewal fees.

- Q2. Where can the rewards points be redeemed?

A2. Rewards can be redeemed for Harley-Davidson gift cards to use at authorized dealerships and retail stores. Every 2,500 points is worth $25 in gift cards.

- Q3. Is there a signup bonus for new applicants?

A3. Currently, there are no public new account bonuses or signup incentives offered.

- Q4. Do authorized users also get rewards points?

A4. Yes, accounts with authorized users allow points to be earned across all cards issued on that account.

- Q5. Is there an option to design a custom Visa card?

A5. Yes, Signature cardholders can personalize and design the picture on the front of their Harley Visa card for free.

- Q6. Can the Harley Visa card be managed online?

A6. Yes, users can register their accounts on the U.S. Bank online portal for easy account access to track balances, statements, payments, etc.

- Q7. Are there any foreign transaction fees?

A7. The Harley Visa cards do not charge additional fees for international transactions. Normal currency conversion rates apply.

- Q8. Can existing U.S. Bank cardholders upgrade?

A8. You may request an upgrade from another U.S. Bank rewards card to the Harley-Davidson Visa Signature card after the first 12 monthly statements.

- Q9. How many cards can be issued on one account?

A9. A maximum of 3 total cards – the primary card plus 2 authorized user cards – can be issued per account.

- Q10. Is the Harley Visa a World or World Elite Card?

A10. The Harley-Davidson Visa Signature card is classified as a standard Visa Signature card, not a World/World Elite card.

5 Best Alternatives to the Harley Visa Card

Here are 5 other excellent co-branded credit cards for bike lovers to consider:

- American Express Harley-Davidson Credit Card – Also offers tiered purchase rewards, plus flexible financing options for H-D bike purchases.

- REI Co-op World Elite Mastercard – Great for outdoor adventures with 5% cashback on REI purchases and no annual fee.

- GM BuyPower Card – Provides exclusive financing offers and discounts at Chevrolet, Buick, GMC, and Cadillac dealers.

- Starbucks Rewards Visa Card – Earns Stars redeemable for drinks and food at Starbucks outlets with no annual fee.

- Capital One Walmart Rewards MasterCard – 5% in-store cashback rewards rate with Walmart purchases is hard to beat.

Conclusion:

The Harley-Davidson Visa credit card lets bikers hit the road while raking up motorcycle merch and gas rewards every mile of the way.

Between tiered purchase rewards, discount financing offers, custom card designs, and comprehensive account benefits – H-D Visa cardmembers can ride in VIP style across every highway after applying for the card at www.h-dvisa.com/myoffer.