Have you gotten a pre-approved offer from Credit One Bank in the mail? If it includes an approval code and directs you to the Accept.CreditOneBank.com Approval Code, you may be wondering what it’s all about.

As someone trying to understand credit cards and improve my credit, I was curious to learn more when I received the mailer. Credit One Bank provides credit cards for folks with less-than-ideal credit, so I thought it could be a good option for me.

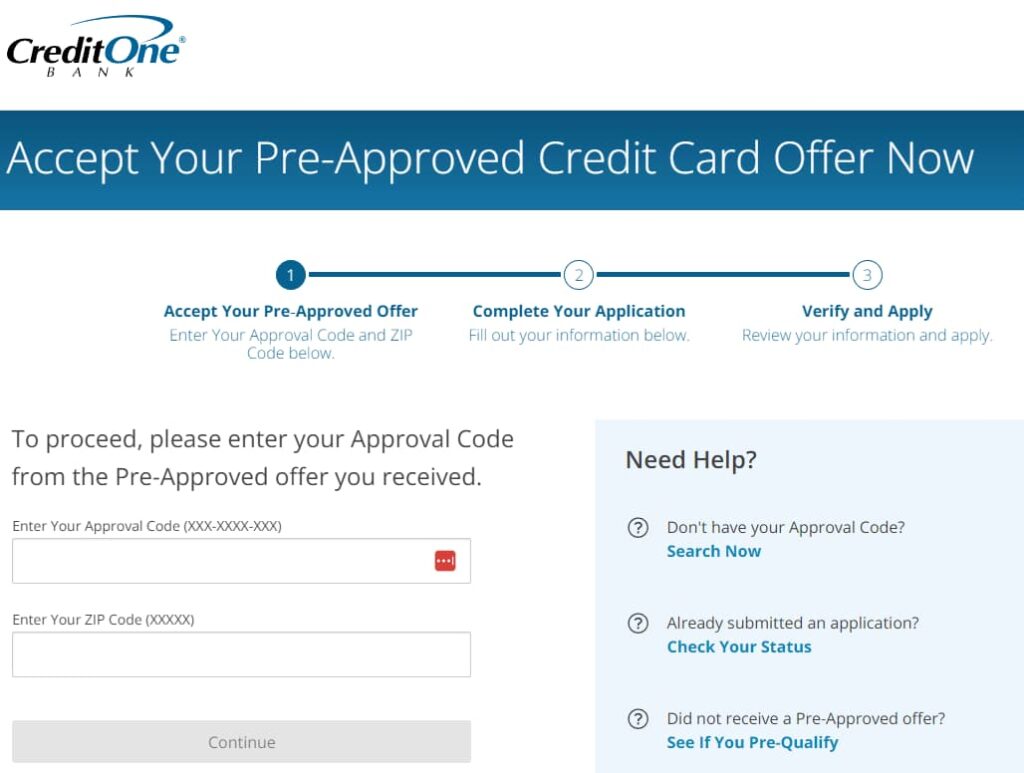

Their website Accept.CreditOneBank.com is where you input the approval code to complete a quick application and accept your pre-approved offer.

Accept.CreditOneBank.com Approval Code

In this article, I’ll discuss my experience looking into Credit One Bank, whether the offer is legitimate, who’s eligible for their credit cards, how to log in and manage your account online, what credit score you need, fees to be aware of, and ultimately whether a Credit One card is worth it for rebuilding credit.

As someone new to credit, I hoped to learn if this offer would help or hurt my score. Let me walk you through what I discovered as a consumer researching Credit One for the first time.

About Credit One Bank:

Credit One Bank is a legitimate lender that issues credit cards for people with less-than-perfect credit. They are based in Las Vegas and have been in business since 1984. Compared to major issuers like Chase and Capital One, Credit One is a relatively small bank that caters specifically to subprime borrowers.

While you may not have heard of them before, Credit One is the eighth-largest credit card issuer in the United States. They have over 10 million cardholders and specialize in helping consumers build a credit history.

What is the Accept.CreditOneBank.com Approval Code?

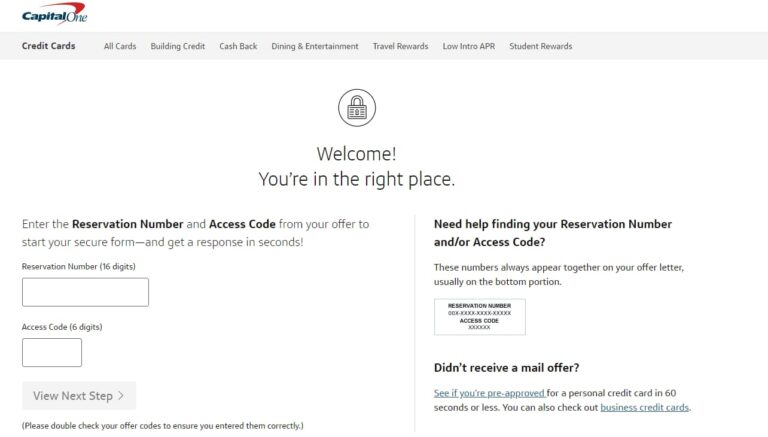

When you receive a pre-selected offer from Credit One Bank, it will include a promotion code and direct you to visit Accept.CreditOneBank.com. This is where you can submit an application to accept the pre-approved offer.

Pre-screened or pre-approved offers mean the bank has already done a soft credit check and pre-qualified you based on your credit profile. Entering the promotion code does not guarantee approval, but it indicates you have been singled out as a good candidate.

Applying with a special offer allows Credit One to skip some of the application steps and helps expedite the approval process. You still have to provide personal information and pass identity verification, but you can expect a quicker decision.

Who is Eligible for a Credit One Bank Credit Card?

Credit One cards are designed for consumers with poor or fair credit. They suggest a minimum credit score of 300-670 for approval, but you could qualify even lower by accepting an Accept.CreditOneBank.com Approval Code.

To apply, you must:

- Be at least 18 years old.

- Have a valid Social Security Number.

- Be a legal U.S. resident.

Credit One does not issue cards to non-citizens, foreign nationals, or anyone without an SSN. They cater mainly to U.S. consumers looking to build domestic credit.

How to Apply for a Credit One Bank Credit Card?

If you received a pre-screened offer by mail, follow these steps:

- Visit Accept.CreditOneBank.com.

- Enter the promotion code printed on the offer.

- Fill out the online application (takes 5-10 minutes).

- Submit your application.

Even without a special code, you can apply directly at CreditOneBank.com. Just know your approval odds are lower without pre-approval.

Application requirements include:

- Name, birthdate and SSN

- Residential address

- Annual income

- Employment details

If approved, you’ll pick your card design and provide a phone number to manage the account. The entire application takes less than 15 minutes for most people.

What are the Benefits of Credit One Bank Credit Cards?

Some benefits of Credit One cards include:

- Easy to qualify if you have poor credit.

- Pre-approvals increase acceptance odds.

- Can help establish or rebuild your credit history.

- U.S.-based customer service agents.

- Online account management and bill pay.

- Choose your card design from options like the American flag or beach scene.

- Request a credit line increase after 61 days of on-time payments.

Potential drawbacks:

- Numerous fees including annual, monthly, and foreign transactions.

- Low starting credit limits of $300 – $500.

- High-interest rates of around 25%.

- Difficult to qualify for credit line increases.

- No rewards program.

- Mixed reviews of the customer service department.

How do Credit One Bank Credit Cards compare?

Compared to other starter credit cards, Credit One gets average to poor reviews. Sites like Credit Karma rate them around 2 stars out of 5 due to the limited benefits and high fees.

Their biggest advantage is easy approval for people with bad credit. But issuers like Capital One and Discover offer secured cards with lower fees and the chance to graduate to unsecured cards.

For credit building, Credit One can help in a pinch. But make sure you understand the costs associated with their card and read reviews before applying.

Tips for Managing Your Credit One Bank Credit Card

If you open a Credit One card, follow these tips for responsible use:

- Pay on time and in full each month to avoid fees.

- Setup autopay if possible to ensure you never miss a payment.

- Keep credit utilization low by not maxing out your limit.

- Avoid cash advances or balance transfers which incur fees.

- Sign up for account alerts and monitor your credit report.

- Ask for a credit line increase after 12 months of on-time payments.

- Contact customer service if you have billing errors or account issues.

How to Contact Credit One Bank?

You can reach Credit One customer service by:

Phone:

- Toll-free in the U.S.: 1-877-825-3242

- Outside the U.S.: 1-702-405-2042

Mail: Credit One Bank: P.O. Box 98873 Las Vegas, NV 89193

Online: www.creditonebank.com/contact-us

Is the Credit One Bank offer a scam?

No. Credit One Bank is an FDIC-insured institution and a legitimate lender. While you should understand their fees, pre-approved offers from Credit One are genuine.

Some customers complain Credit One lures people in with pre-approvals and then issues very low limits with high-interest rates. But they are upfront about fees and represent a real credit card you can use to build history.

Just read the fine print so you know the annual fee, APR, and all charges before accepting any offer. Make sure the card is right for your needs.

Also Check:

- PaperlessEmployee WhatABurger Login

- BHGWalmartOffer

- Citi.com/LoveCitiSimplicity Invitation Code

- EZ Pass NY Login

- Target.com/CheckBalance

- E-ZPassny.com/Payviolation

- Activate.LLBean Mastercard.com

Conclusion:

At the end of the day, Credit One Bank offers an accessible credit card for people with poor credit. It can help establish a credit history if you don’t have any and show positive payment activity if you have bad credit.

Just be prepared for higher-than-average interest rates and account fees. Compare your options to find the best card for rebuilding credit based on your spending habits and income.

A Credit One card can help in certain situations, but weigh the costs and benefits before applying. With responsible use over time, a Credit One card may act as a stepping stone to rebuilding and improving your credit.

So, we hope now you know everything about Accept.CreditOneBank.com Approval Code and more.